Image Source- DNA India

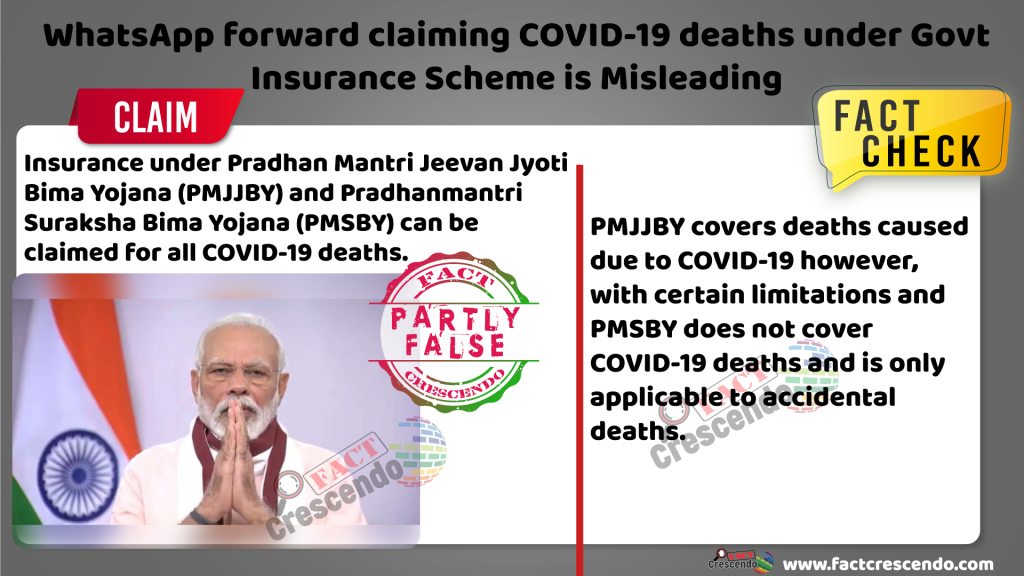

In light of the increasing death’s due to COVID-19 infections a WhatsApp forward is being circulated with the claim that insurance benefits for COVID-19 deaths can be claimed under two of the PM’s Suraksha Yojana Schemes, Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY). The message reads, “”If someone in close relative/friends circle has died due to Covid-19 or for any reason, ask the bank for an account statement or passbook entry from 01-04 to 31-03 of the financial year. Seeing the entry of Rs. 12/- or Rs. 330/- mark it, Go to the bank and Claim for Insurance. My Humble Request to All of You is that if such cases happen around you,” The message mentions about two existing schemes by the Indian Government.

Fact Crescendo has received this message for verification on our WhatsApp Fact Line number 9049053770. Post our research we found that this forward is going viral across social media platforms.

Fact Check–

We started our investigation by running a keyword search on Google which led us to PM Modi’s Pradhan Mantri Jan Dhan Yojana launched on 28th August 2015. Under this, two schemes were announced for providing social security at affordable premiums to citizens who hold savings bank accounts.

Next, we did a keyword search on the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and the Pradhan Mantri Suraksha Bima Yojana (PMSBY).

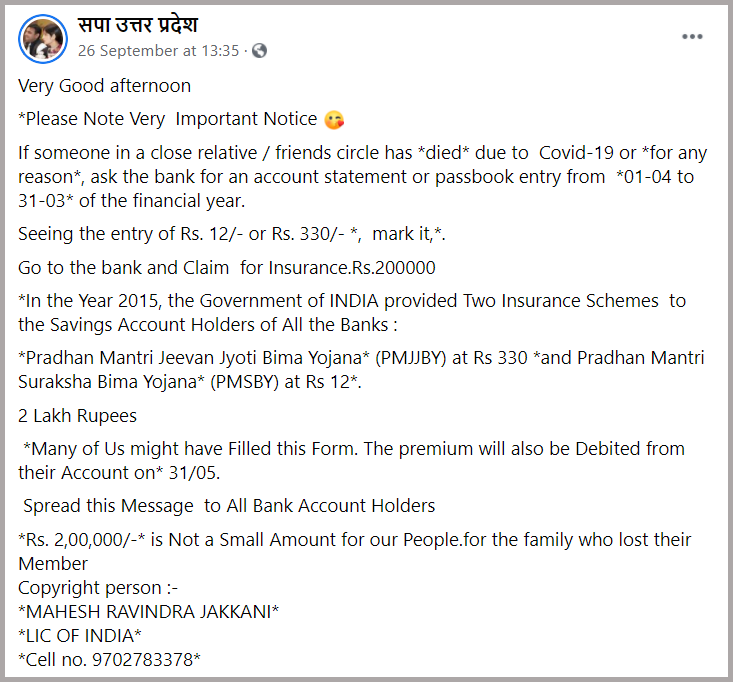

The Pradhan Mantri Suraksha Bima Yojana (PMSBY)-

It is applicable in cases of accidental deaths or permanent disabilities. The scheme is aimed at people in the age group of 18 to 70 years with a savings bank account who give their consent to join and enable auto-debit on or before 31st May for the coverage period of 1st June to 31st May on an annual renewal basis. This scheme covers a population of 18-75 at an affordable premium of Rs.12 per annum. According to the Insurance Regulatory and Development Authority, accidental death indicates death caused by the sudden, unintended and fortuitous external and visible event. Therefore, under this scheme, COVID-19 deaths are not considered as accidental deaths. You can read more about the scheme by clicking here.

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)–

It is a one-year life insurance scheme, renewable from year to year, offering coverage for death due to any reason and is available to people in the age group of 18 to 50 years( life cover up to age 55) having a savings bank account and who give their consent to join and enable auto-debit.

Under PMJJBY scheme, life cover of Rs. 2 lakhs is available for a one year period stretching from 1st June to 31st May at a premium of Rs.330/- per annum per member and is renewable every year. It is offered/administered through LIC and other Indian private Life Insurance companies. For enrolling, banks have tied up with insurance companies. Participating Bank is the Master policy holder.

The assurance on the life of the member shall terminate on any of the following events and no benefit will become payable there under:

1) On attaining age 55 years (age near birth day) subject to annual renewal up to that date (entry, however, will not be possible beyond the age of 50 years).

2) Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

3) A person can join PMJJBY with one Insurance company with one bank account only. The specifics of the scheme can be read here.

Therefore, COVID-19 deaths are included in the scope of reasons where the PMJJBY claim is applicable. However, this scheme will not be applicable if the claimant does not have a bank account or does not belong to the 18-55 age group. Further, COVID-19 deaths of people older than 55 are not liable to benefit from this scheme. You can read more about the scheme by clicking here.

Conclusion- Fact Crescendo found the viral message on social media to be Partly False. PMJJBY covers deaths caused due to COVID-19 however, with certain limitations. The scheme is only applicable to people who are presently holding a savings bank account ,they must be between the ages of 18-55 and they are required have voluntarily signed up for the scheme that was launched in 2015. The other scheme, PMSBY does not cover COVID-19 deaths since it is only applicable to accidental deaths.

Title:WhatsApp forward claiming COVID-19 deaths under Govt Insurance Scheme is Misleading

Fact Check By: Aavya RayResult: Partly False