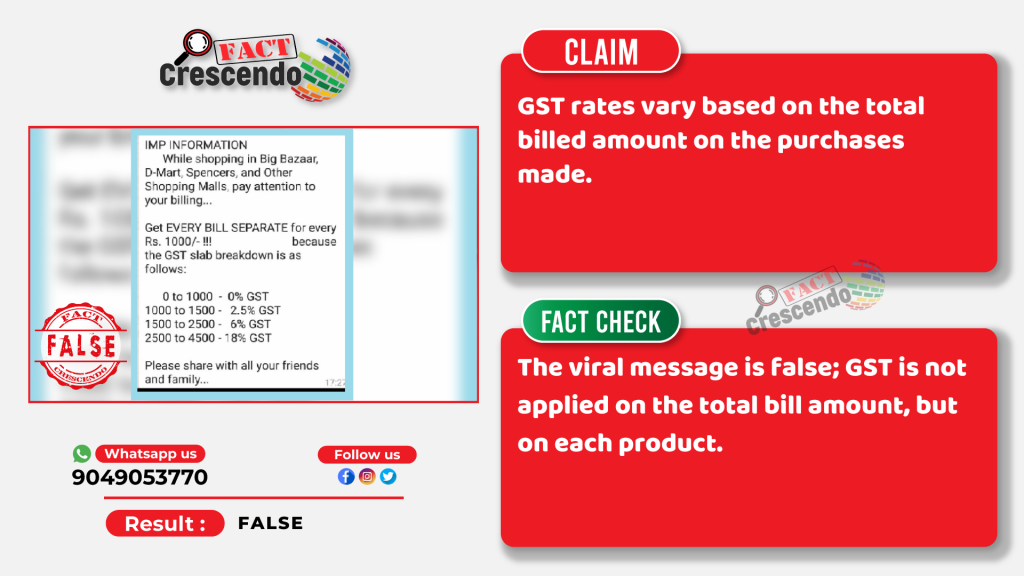

PIB of Finance ministry clarified to us that the viral message is Fake.

The government issued nine Central Tax (Rate) notifications on 13th July 2022. These GST rate changes were applied from 18th July 2022. Further, exemptions were withdrawn on a few daily essentials. The government notified that the revised rates for the items faced an inverted tax structure.

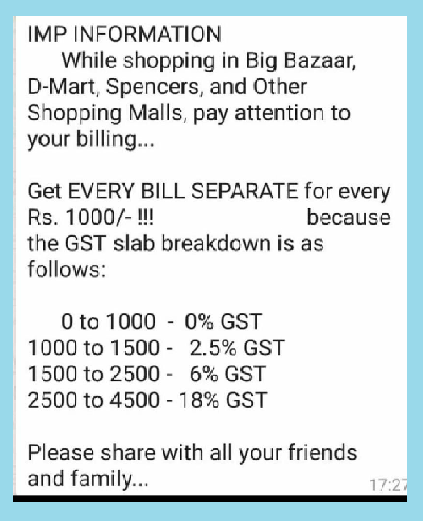

Amidst this, a viral image on social media claims to show the revised GST rates after shopping in Big Bazaar, D-Mart, Spencers and other shopping malls. The rates structure mentioned states that there will be a separate bill for every Rs 1000. The tax slab breakdown mentions, that there is 0% GST on shopping upto Rs 1000, 2.5% GST on a bill of Rs 1000 to Rs 1500, 6% GST on a bill of Rs 1500 to Rs 2500 and 18% GST on a shopping bill of Rs 2500 to Rs 4500.

The message says that no GST will be levied on bills below ₹1,000, while the tax will increase as the amount increases.

The message is widely circulating on Facebook as well.

Fact Check-

We started our investigation to go through the new tax slab to find the GST rates for the shopping bills in stores like Big Bazaar, D-Mart and Spencers. However, we could not find any relevant details on the GST tax rates on shopping bills above Rs 1000. These are the updated GST rates according to CBIC’s website.

We found that this message had also gone viral in 2017. D-Mart had also published a denial on their Facebook page on 8 July 2017. The Facebook post says, GST rates are applied on each product and rates for each product are based on definition as per rules defined by the tax authorities of the government of India, and GST rates are not based on bill value.

Next, Fact Crescendo contacted Kush Mohan Nahar from PIB of the union Finance ministry who confirmed to us that the viral message is False. He said that there are no such tax slabs on total bill amount. GST is applied on a particular type of category, it is not according to money slabs. It must be noted that GST is not applied on the total bill amount, but on each product.

GST is an indirect tax that customers must bear when they buy any goods or services, such as food, clothes, electronics, items of daily needs, transportation, travel, etc.

Conclusion-

Fact Crescendo found the claim made along with the viral message to be False. The GST rates are not based on the total bill amount similar to income tax. The GST rates vary based on the type of product purchased. The GST council decides the rates for each product category.

Title:There is no GST charge on the total billed amount in shopping malls

Fact Check By: Drabanti GhoshResult: False