The reach of smartphones, online banking, and instant payments has made life easier in many ways. According to Government of India, more than 86 percent of households now have internet access. But with this growth comes a serious and growing challenge: online scams.

Recently, Press Information Bureau (PIB) released a report on the growing challenge of online scams in India. The total number of reported cyber-security incidents rose from 10.29 lakh in 2022 to 22.68 lakh in 2024. That tells us that more people are being targeted, and the methods are becoming more sophisticated.

According to the National Cyber Crime Reporting Portal, the value of online scams reported stood at around ₹36.45 lakh as of 28 February 2025. These are not just numbers; they point to real people losing money, data, or their digital identities.

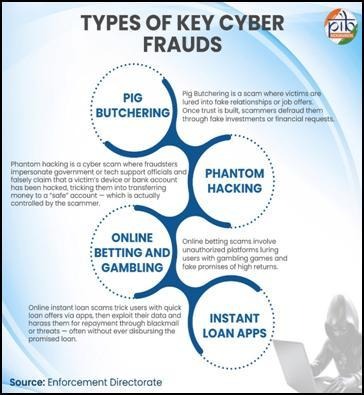

So how are these frauds happening?

One key technique is spoofing, where a fraudster pretends to be a trusted organisation or person. For example, you might get a message that looks like it comes from your bank or your SIM card company, asking you to click a link or verify something.

Another method is phishing, where a crook lures you into revealing passwords, OTPs or bank details through deceptive emails or apps.

At the same time, even the popular payments system, UPI (Unified Payments Interface) is being targeted. Fraudsters are using compromised mobile numbers and other tricks to steal money.

Online money gaming apps with promises of big returns are also emerging as dangerous methods for scams.

The report notes that the government has blocked millions of SIM cards and device IMEIs which were linked to fraud, and created the Indian Cybercrime Coordination Centre (I4C) and CERT-In to coordinate investigations and responses.

A special portal has been set up—National Cyber Crime Reporting Portal—where citizens can lodge complaints, and a helpline number (1930) is available for victims of financial cyberfraud.

The Union Budget for 2025-26 also allocated ₹782 crore for cybersecurity projects.

What does this mean for you in everyday life?

It means we cannot be casual when we click a message, open a link or download an app. If someone asks for your OTP, password or to install a screen-sharing app “to help you”, that is a strong warning sign. If an offer of “huge returns” or “get rich quick” is made via an app or game, it is very likely a trap.

We should always verify from official channels—banks, service providers or government websites—before we trust anything. Whenever in doubt, it is better to pause and check rather than rush and regret.

By staying alert, asking questions, and not assuming that everything online is safe, we can make sure our journey in the digital world remains empowering, not dangerous.

You can read the full report here.