Have you ever experienced the delightful surprise of reaching into the pocket of an old pair of jeans only to find a forgotten Rs 100 note? What an unexpected joy is that!

Well, imagine that same feeling, but on a much grander scale. Imagine learning that you or your deceased family members have money lying in bank accounts for decades – money you had no idea even existed.

The Reserve Bank of India (RBI) has pulled off something similar to those pocket-moments with its new UDGAM portal.

RBI has introduced a centralized web portal called UDGAM (Unclaimed Deposits – Gateway to access information) to help citizens search for their unclaimed deposits. UDGAM makes it easier to search unclaimed deposits across multiple banks in one place.

It’s as if RBI has scoured the nation’s financial pockets for us to find our long-lost money hiding in the coffers of the banking system. Just like discovering crumpled cash in old pants, UDGAM initiative promises to help us find unclaimed deposits that might have slipped through the cracks of our memory.

What Is UDGAM?

UDGAM (उद्गम) stands for “Unclaimed Deposits – Gateway to Access inforMation.”

The portal was initially announced by the RBI in a statement on 6 April 2023, as part of its developmental and regulatory policies.

The primary aim of the UDGAM portal is to make it easy for people to search for information regarding their unclaimed deposits. It’s like a one-stop place where you can find old accounts that you haven’t used for a while.

The RBI wants to make more people aware of this and make it simple for them to find their lost money or make their old accounts active again.

Seven Banks Available

Currently, the portal provides information related to unclaimed deposits from seven banks. These banks are:

- State Bank of India,

- Punjab National Bank,

- South Indian Bank,

- Central Bank of India,

- Dhanlaxmi Bank,

- DBS Bank India,

- CitiBank N.A.

The information for other banks will be gradually integrated into the portal in a phased manner, with the search functionality for remaining banks expected to be available by 15 October 2023.

What Is Unclaimed Deposit?

Unclaimed deposits are funds that you have in bank accounts that have been inactive or dormant for a long time and you haven’t used or taken back.

According to RBI, if you don’t operate a savings or current account for 10 years, or if a fixed deposit isn’t claimed within 10 years after its maturity date, the bank classifies these as “Unclaimed Deposits.”

The reasons for deposits becoming unclaimed can vary. For example, you might forget about an account you opened, change your contact details without telling the bank, or even if you pass away and your family doesn’t know about the accounts.

As time goes by and if you don’t use or communicate about the account, the rules require banks to consider these accounts as inactive or unclaimed. These amounts are transferred by banks to ‘Depositor Education and Awareness” (DEA) Fund maintained by RBI.

What Was The Need For UDGAM?

The decision to create such a portal was prompted by the increasing amount of unclaimed deposits in the banking system.

As of February 2023, public sector banks (PSBs) had approximately Rs 35,000 crore of unclaimed deposits which they handed over to RBI. These unclaimed deposits were linked to accounts that hadn’t been active for 10 years or even longer.

Minister of State for Finance Bhagwat Karad informed the Lok Sabha that around 10.24 crore such inactive accounts were moved to the Reserve Bank of India (RBI).

With Rs 8,086 crore, State Bank of India (SBI) is at the top with the highest amount of unclaimed deposits. After that, there’s Punjab National Bank with Rs 5,340 crore, and then Canara Bank with Rs 4,558 crore. Lastly, Bank of Baroda has unclaimed deposits totalling Rs 3,904 crore.

How to Use UDGAM Portal?

To begin, visit the website of UDGAM portal.

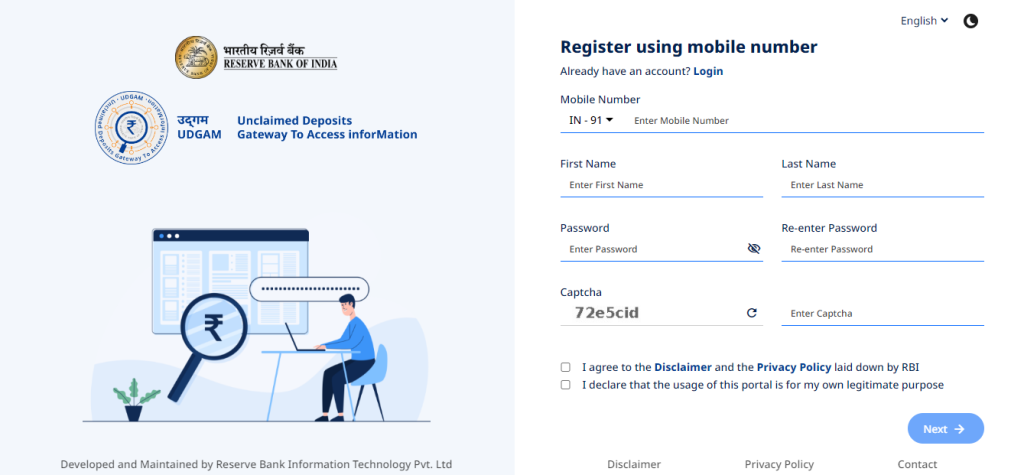

You will need to register or create an account on the portal. Give your mobile number, name, chosen password, and complete the CAPTCHA. Following submission, you’ll receive a One-Time Password (OTP) on the mobile number you registered.

Once your account is set up, you can proceed to check unclaimed deposits.

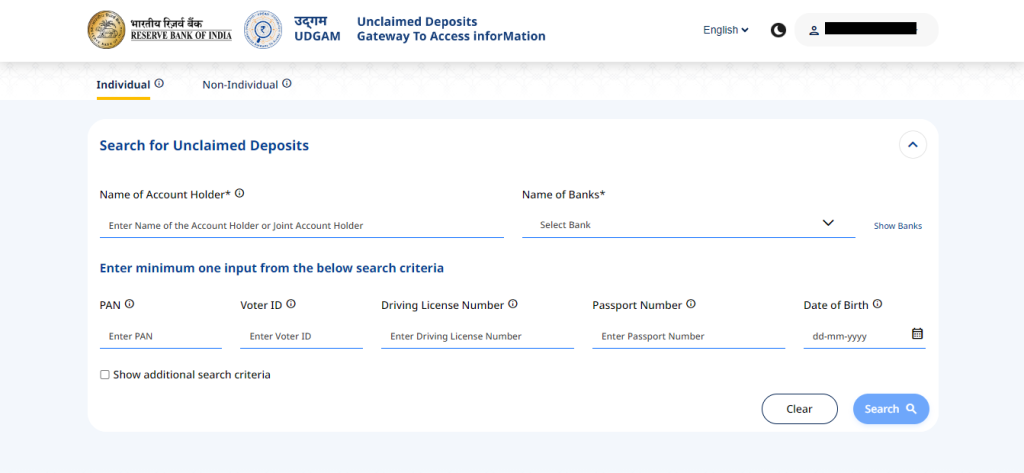

Upon logging in to the portal, you will be directed to a page where you can choose between two options:

- Individual for Accounts belonging to a person.

- Non-individual for Accounts belonging to HUF, proprietorship, partnership, firm company

If you’re searching for unclaimed deposits linked to an individual, you’ll need to provide the account holder’s name, the name of the relevant bank(s) holding the deposits, and at least one search criterion. You can choose from options such as PAN, Voter ID, Driving License Number, Passport Number, or Date of Birth. You can also provide your address as an additional search criteria.

For a non-individual search, you’ll be required to provide the name of the entity and at least one piece of information from the following options: Name of the Authorized Signatory, PAN, corporate identification number (CIN), or date of Incorporation.

After entering the required information, simply click the “Search” button.

The portal will then display any unclaimed deposits associated with the provided details.

Last Word

The UDGAM portal is a big step to deal with the issue of unclaimed deposits. This easy-to-use website helps people find money they left in banks. It’s like a helpful tool to find old money and bring back accounts they haven’t used for a while. The UDGAM portal makes it simple to look for lost money in different banks and helps more people know about their finances. As more banks join the portal, it will become even more useful in bringing back unclaimed deposits for people, which is a great way to make sure everyone’s money is safe and easy to access.

Title:UDGAM Portal: Here’s How You Can Check Your Unclaimed Deposits In Banks

Written By: Mayur DeokarResult: INSIGHT